Getting My Clark Wealth Partners To Work

All About Clark Wealth Partners

Table of ContentsFascination About Clark Wealth PartnersThe Ultimate Guide To Clark Wealth PartnersThe smart Trick of Clark Wealth Partners That Nobody is DiscussingSome Known Facts About Clark Wealth Partners.The Single Strategy To Use For Clark Wealth PartnersMore About Clark Wealth PartnersMore About Clark Wealth PartnersExcitement About Clark Wealth Partners

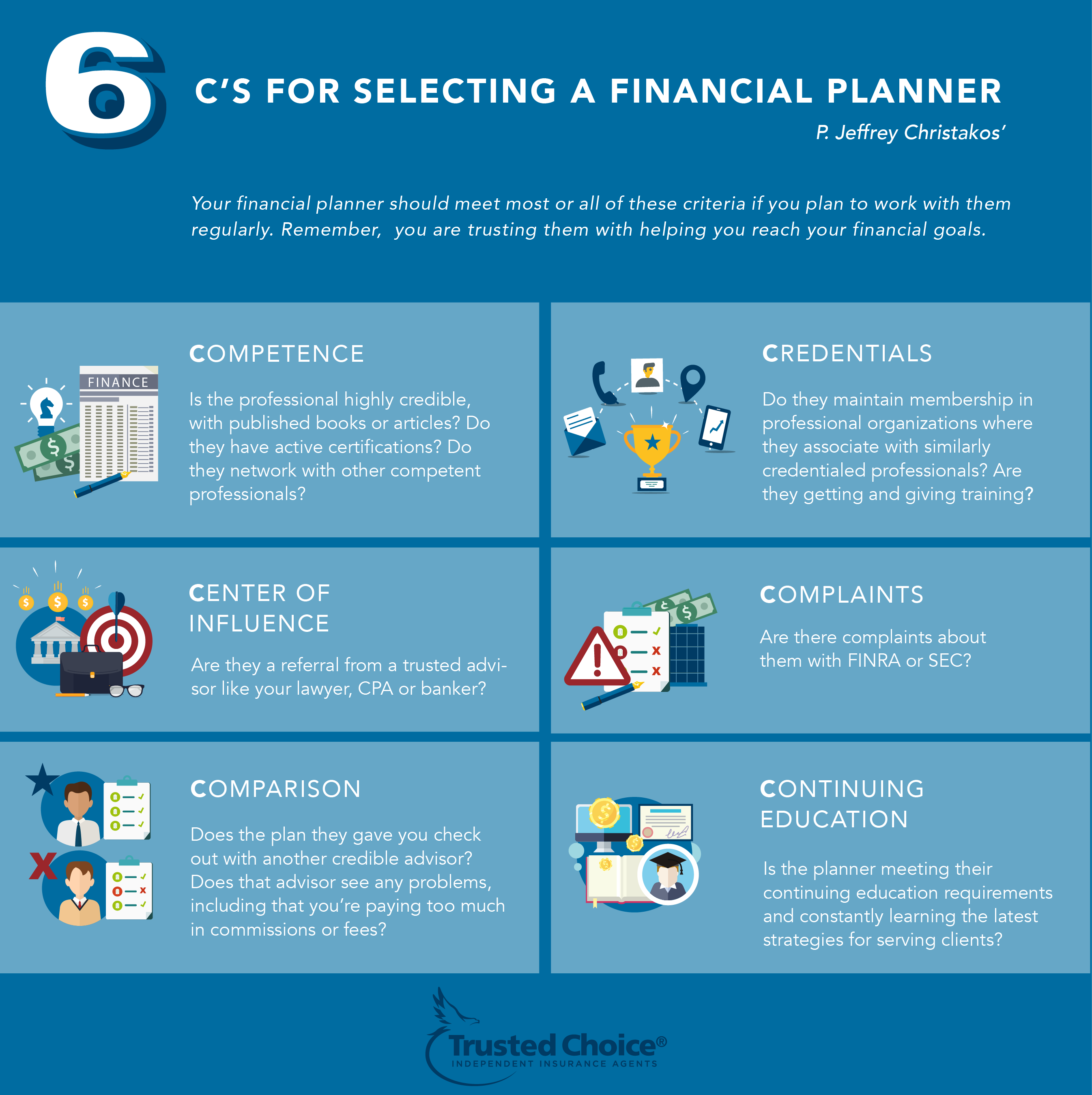

Common factors to think about a financial expert are: If your monetary scenario has actually ended up being extra complicated, or you lack self-confidence in your money-managing abilities. Saving or navigating major life occasions like marriage, divorce, youngsters, inheritance, or task adjustment that may significantly influence your financial scenario. Navigating the shift from saving for retired life to protecting wide range throughout retired life and exactly how to create a solid retired life income plan.New modern technology has caused even more detailed automated economic tools, like robo-advisors. It's up to you to check out and determine the best fit - https://go.bubbl.us/eed870/6aac?/New-Mind-Map. Ultimately, a great economic advisor must be as conscious of your investments as they are with their own, staying clear of too much fees, saving cash on tax obligations, and being as transparent as possible regarding your gains and losses

Not known Incorrect Statements About Clark Wealth Partners

Earning a commission on product recommendations doesn't necessarily mean your fee-based advisor antagonizes your benefits. But they may be much more inclined to recommend product or services on which they gain a commission, which might or may not remain in your benefit. A fiduciary is legitimately bound to put their customer's passions initially.

This common enables them to make referrals for investments and solutions as long as they match their client's objectives, danger tolerance, and economic circumstance. On the various other hand, fiduciary consultants are legally obliged to act in their customer's ideal rate of interest instead than their very own.

The 30-Second Trick For Clark Wealth Partners

ExperienceTessa reported on all points investing deep-diving into intricate financial subjects, clarifying lesser-known investment methods, and revealing ways viewers can work the system to their advantage. As a personal finance specialist in her 20s, Tessa is acutely mindful of the effects time and unpredictability have on your investment decisions.

:max_bytes(150000):strip_icc()/financial-advisor-career-information-526017_final-9c1362c7706146ada8c9173002ddee69.png)

It was a targeted advertisement, and it worked. Find out more Review less.

A Biased View of Clark Wealth Partners

There's no single path to turning into one, with some individuals beginning in banking or insurance coverage, while others start in accountancy. 1Most economic coordinators begin with a bachelor's level in finance, business economics, accountancy, company, or a related subject. A four-year degree provides a solid structure for jobs in investments, budgeting, and customer service.

Clark Wealth Partners Things To Know Before You Buy

Typical instances consist of the FINRA Series 7 and Collection 65 exams for safeties, or a state-issued insurance coverage license for marketing life or medical insurance. While qualifications may not be legitimately needed for all planning functions, companies and clients typically see them as a benchmark of professionalism and trust. We look at optional qualifications in the following area.

The majority of economic coordinators have 1-3 years of experience and experience with economic products, conformity criteria, and direct customer interaction. A solid instructional background is essential, yet experience shows the ability to apply theory in real-world setups. Some programs integrate both, allowing you to finish coursework while earning monitored hours through internships and practicums.

Some Known Facts About Clark Wealth Partners.

Several get in the field after operating in banking, bookkeeping, or insurance, and the transition requires persistence, networking, and often sophisticated credentials. Early years can bring lengthy hours, stress to build a customer base, and the requirement to continuously show your know-how. Still, the profession offers solid long-lasting potential. Financial organizers enjoy the opportunity to work very closely with clients, guide click here now essential life decisions, and commonly achieve adaptability in timetables or self-employment.

They invested much less time on the client-facing side of the industry. Almost all economic supervisors hold a bachelor's degree, and several have an MBA or similar graduate level.

Top Guidelines Of Clark Wealth Partners

Optional qualifications, such as the CFP, usually require added coursework and testing, which can expand the timeline by a couple of years. According to the Bureau of Labor Statistics, individual monetary experts gain a mean annual yearly wage of $102,140, with top income earners making over $239,000.

In other provinces, there are guidelines that need them to fulfill specific requirements to utilize the economic expert or monetary coordinator titles. For economic organizers, there are 3 common designations: Qualified, Individual and Registered Financial Planner.

The Main Principles Of Clark Wealth Partners

Where to find a monetary expert will depend on the type of recommendations you need. These establishments have personnel who might help you recognize and get certain kinds of investments.